Bitcoin’s (BTC) market capitalization now exceeds the valuation of some of the world’s largest financial institutions amid a sustained bull run that catapulted the largest crypto asset above $48,000.

CoinMarketCap shows that Bitcoin’s market capitalization has soared above $900 billion as it printed a new all-time high of $48,745 on February 12th, surpassing the valuation of financial giants Visa ($462.93 billion), PayPal ($349.44 billion), and Mastercard ($339.10 billion). Bitcoin’s market cap is also larger than the combined value of JPMorgan Chase ($430.72 billion), Bank of America ($288.67 billion), and Citigroup ($132.48 billion) with an aggregate market cap of $851.87 billion, according to data from CompaniesMarketCap.

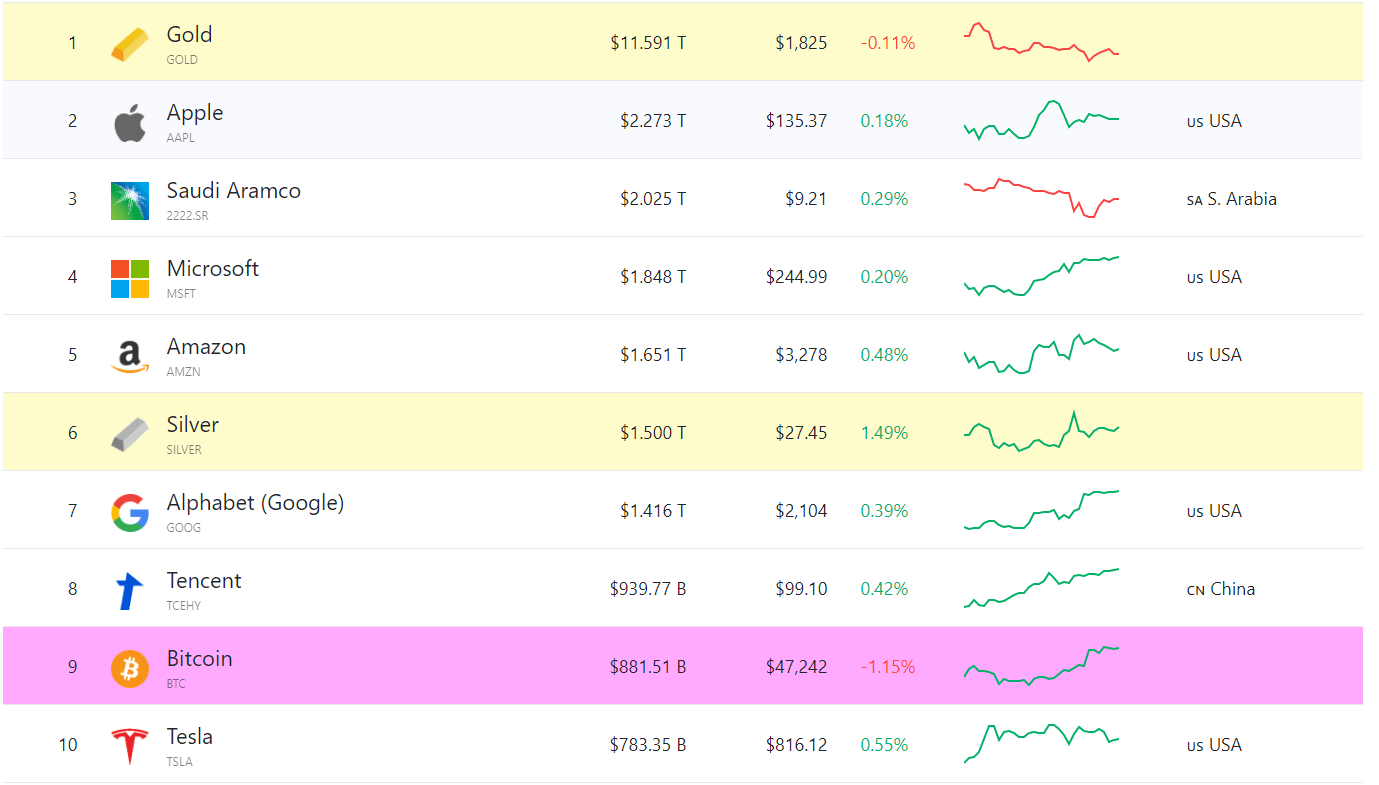

The flagship cryptocurrency is ninth on the list of top assets by market cap. Gold, which has a market cap of $11.59 trillion is in the lead, followed by iPhone maker Apple, petroleum and natural gas titan Saudi Aramco, and tech goliaths Microsoft and Amazon.

The king coin sits above electric car firm Tesla, social media giant Facebook, and Chinese e-commerce company Alibaba in the ranking, but it is below silver, Google-parent company Alphabet, and Shenzhen-based tech firm Tencent.

Ethereum (ETH) also made it in the list of top 100 assets by market cap. The leading smart contract platform takes the 52nd spot with a market capitalization of $209.7, surpassing the valuations of Wells Fargo and Morgan Stanley.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Mmaxer/Aui Meesri