A pseudonymous analyst who nailed Bitcoin’s plummet from $11,600 to $6,400 in 2019 says the bull market top could be on the horizon.

In a new tweet, the crypto strategist known in the industry as Dave the Wave warns his 44,700 followers that Bitcoin’s furious rally from $20,000 to an all-time high of $57,505 in a span of a few months may be running out of steam.

ADVERTISEMENT

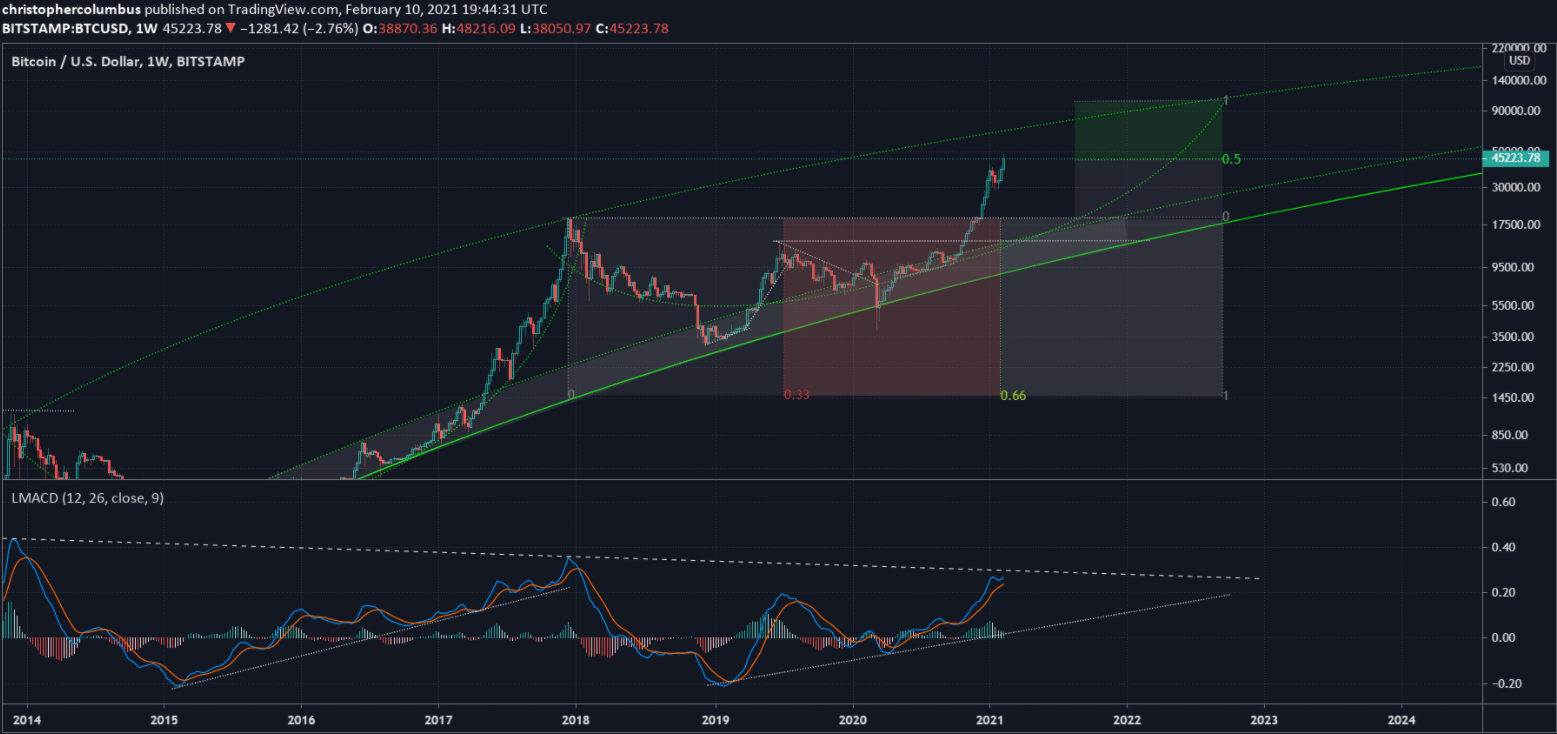

“More symmetries. The Fibonacci measurement from where price meets the bottom of the channel to where price would meet the top of the channel gives the previous peak as the center.

When the parabola corrects, now or a little higher, predicting a 0.38% retracement as per previous spikes.”

According to Dave, Bitcoin can potentially top out at $68,710.15 before igniting a massive correction that would send the leading cryptocurrency all the way back down to its previous bull cycle high of $20,000.

“Looking at this chart, it’s quite conceivable to see BTC back to 20K at some point. Up to the present price has spent a full 2/3s of its time in the ‘buy zone’. As the channel converges, and with increasing price discovery, it’s likely this ratio will decrease – the near-year-long speculative episodes and equally long corrections should come to dominate in an increasingly liquid market at this transitional stage. Multi-year cycles, with extended bases, could become a thing of the past.”

In the long run, however, the trader believes that it is possible for Bitcoin to eventually regain its bullish momentum and climb all the way up to $100,000.

ADVERTISEMENT

“Say price corrected to $20,000 and then went to $100,000. The current price is exactly half-way to that target in real terms. Time wise, you also see a symmetry between the peaks.”

Last year, the trader shared his analysis of Bitcoin’s long-term trajectory, which tracks the cryptocurrency’s past price movements and increasingly long cycles. His chart shows Bitcoin could reach $500,000 sometime around 2029.

“When peaks are ‘stepped,’ they meet on the logarithmic growth curve. With each subsequent cycle – from base to peak – an extra year is added.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

ADVERTISEMENT

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/sdecoret