New analysis from crypto intelligence company Glassnode is revealing massive whale activity amid Bitcoin’s meteoric ascent this year.

The on-chain analytics platform looks at Coinbase, which it labels as the preferred venue of US institutions to accumulate BTC, to show the rapidly dwindling Bitcoin balance on the crypto exchange.

ADVERTISEMENT

According to Glassnode, whales started to heavily accumulate Bitcoin in December 2020 as BTC threatened to take out the previous all-time high of $20,000.

“We can see that in December 2020, the game changed. As BTC price approached the previous cycle ATH at $20,000 and market confidence grew, serious institutional accumulation commenced. This started with 37,400 BTC withdrawn in December.

In the months that followed, an incredible stair-stepping ‘whale cost averaging’ pattern emerged, as tens of thousands of coins were accumulated each month. The consistency, frequency, and size of this balance change are astounding to see play out in on-chain data and really shows the aggressive accumulation by institutions this year.”

Glassnode’s chart reveals that US institutions continue to be a major force behind the current bull market as they take out thousands of BTC in spite of Bitcoin’s rising price. In the first three months of 2021, 170,800 BTC were withdrawn from Coinbase amid Bitcoin’s over 100% surge from $28,873 in January to $58,618 at time of writing.

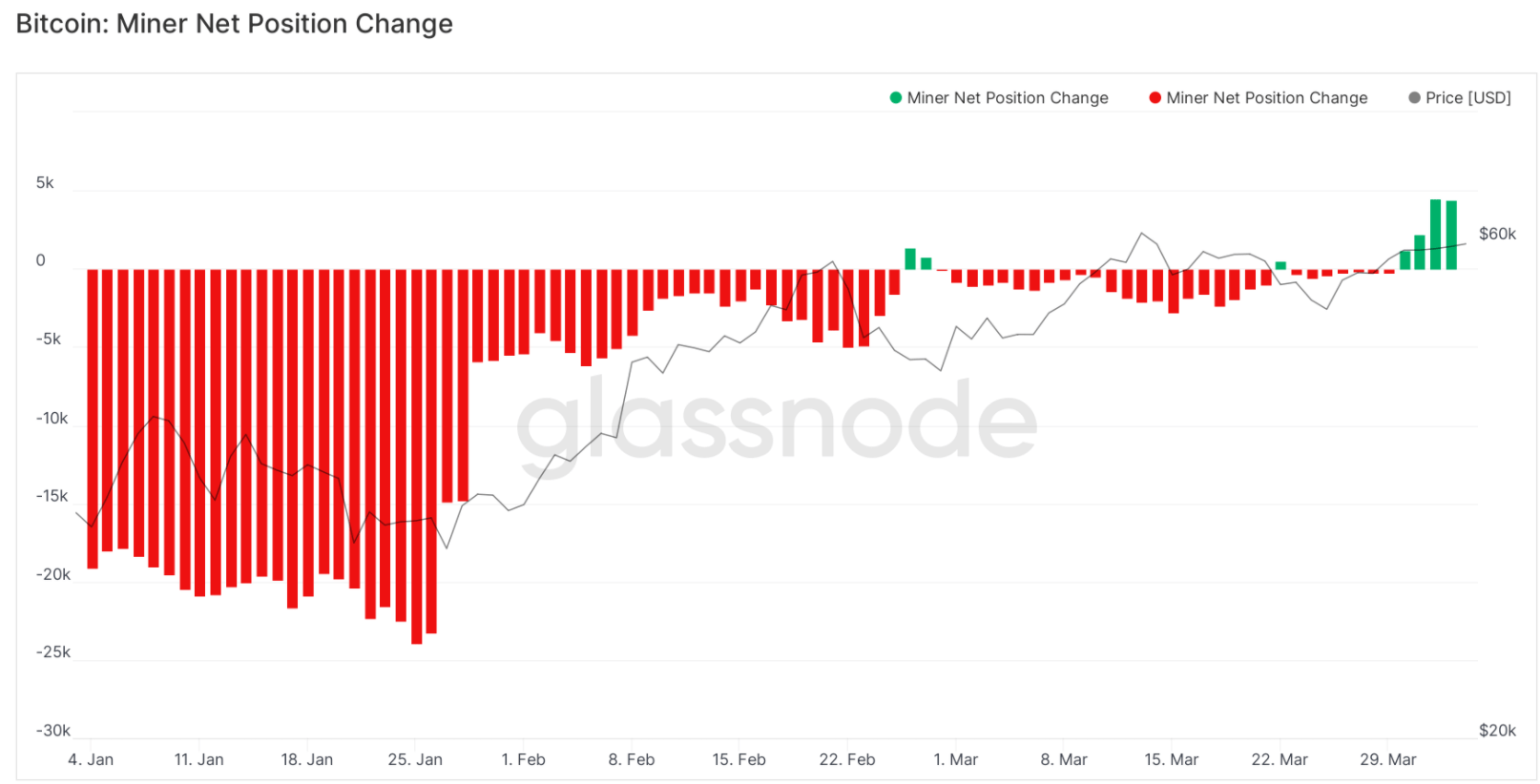

US institutions are not the only big-time players who are accumulating Bitcoin. Quant analyst Lex Moskovski shares data from Glassnode showing that the Bitcoin miner net position has turned positive, indicating that miners are holding more Bitcoin than the amount they’re selling.

“Miners started really ramping up their positions… Another 4,380 Bitcoin stacked by miners yesterday. Looks like a trend, indeed.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

ADVERTISEMENT

ADVERTISEMENT

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Digital Storm